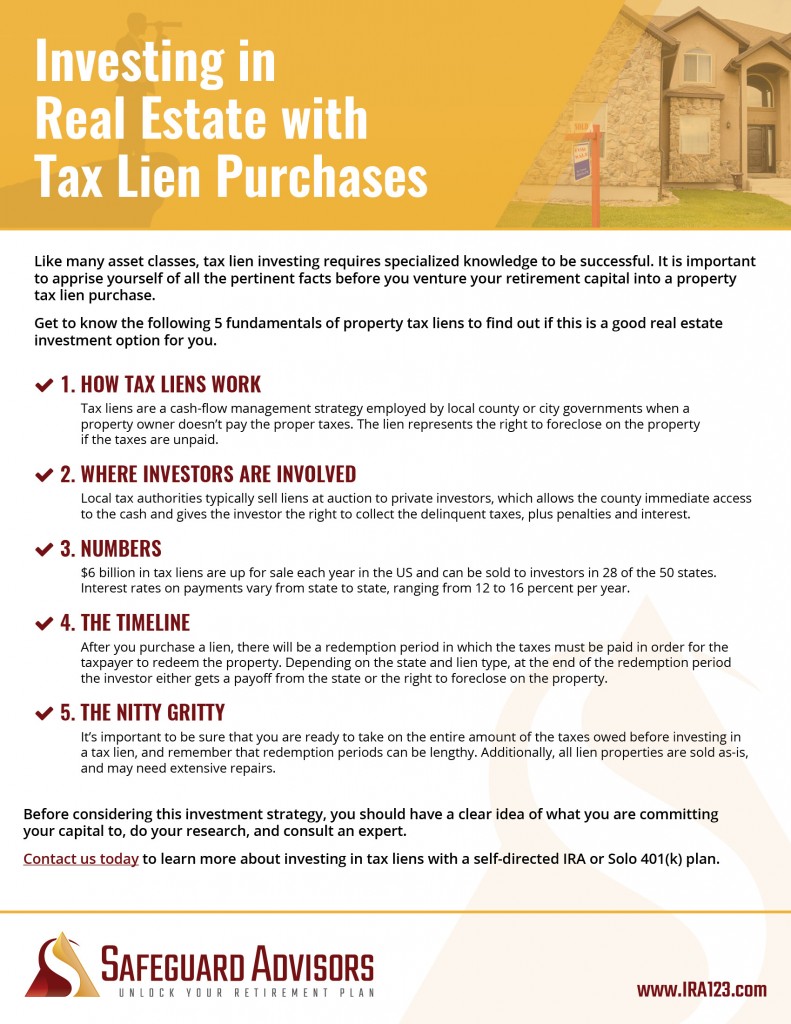

Awe-Inspiring Examples Of Info About How To Buy Property Tax Liens

However, if the owner fails to repay you by the required date—and you follow your counties guidelines for.

How to buy property tax liens. The lien usually allows the lien holder to obtain ownership interests in a house or. They’ve put most of this online. We will issue a tax lien release once your unsecured property tax bill is paid in full.

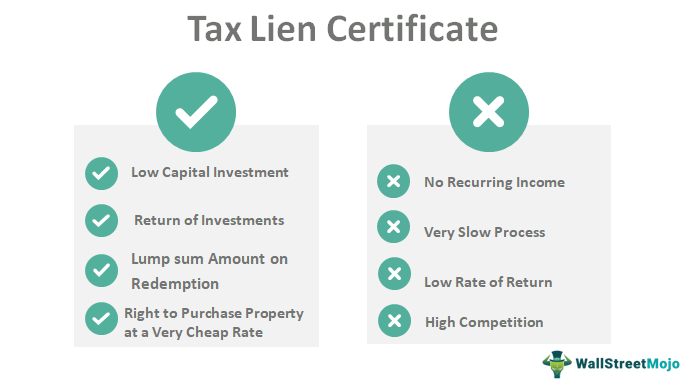

If you buy tax liens as an investment, the interest and other charges the owners pay will come to you. Just remember, each state has its own bidding process. Can you buy a property that has a tax lien?

Tax liens may be imposed on a property for the purpose of collecting outstanding debt on the property. 19 sep how to pay a tax lien on your property. Check your florida tax liens.

The interest rate on these liens varies. In some states, whatever buyer offers. Payment agreements are available whether or not your property has been noticed for a tax lien sale.

Any property owner who is interested in paying their. You can potentially hit the jackpot with a minimal investment in a tax lien, resulting in you becoming the property owner. If you plan to bid on a house at a tax lien sale, you’ll need a cashier’s check.

If you have a tax lien on your property, it means the government has a legal claim to your property as payment for your. That means we can access every tax lien auction and every property, and we can do all of that from where you’re sitting. Tax liens offer many opportunities for you to earn above average returns on your investment dollars.

/GettyImages-1137448188-45959ad13a7f4625b3969fe1fb9295af.jpg)