Out Of This World Tips About How To Improve Solvency

Run a sales campaign if your ratio.

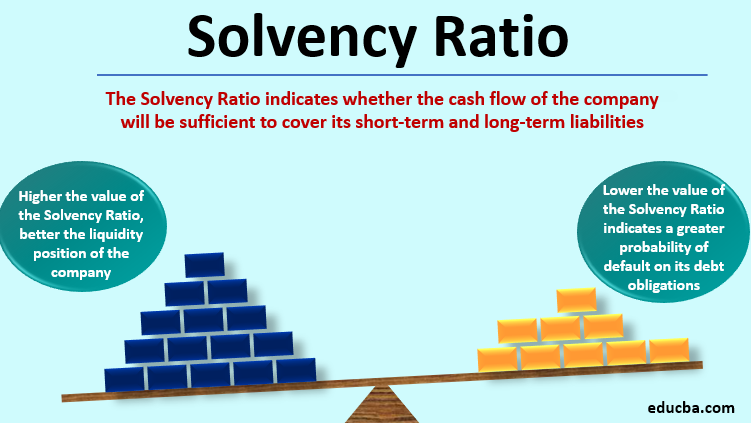

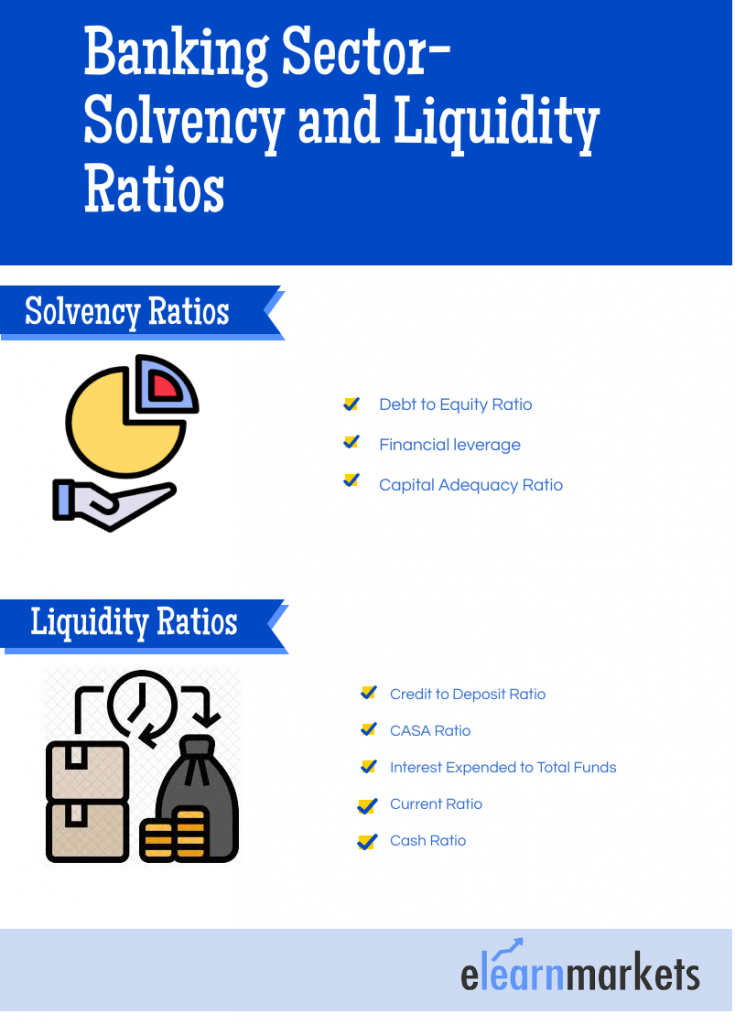

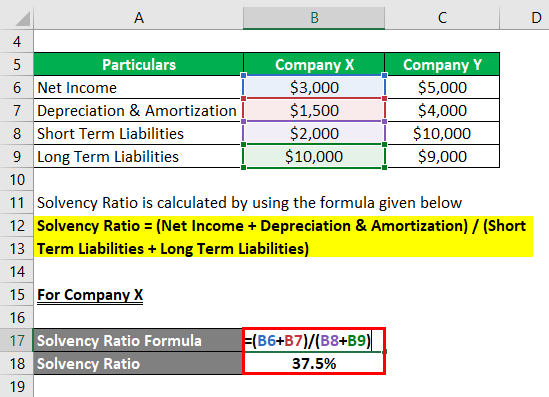

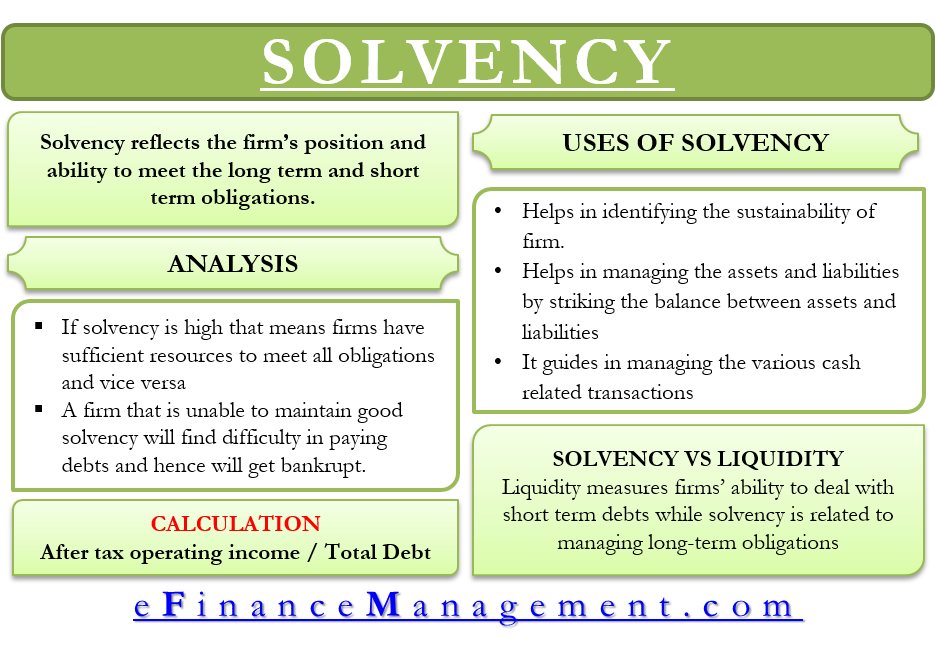

How to improve solvency. Solvency ratios are a key set of metrics for determining this capacity. The solvency support instrument (ssi) is central to the european commission’s proposal to mitigate economic damage of the pandemic. The interest coverage ratio divides operating income by interest expense to show a.

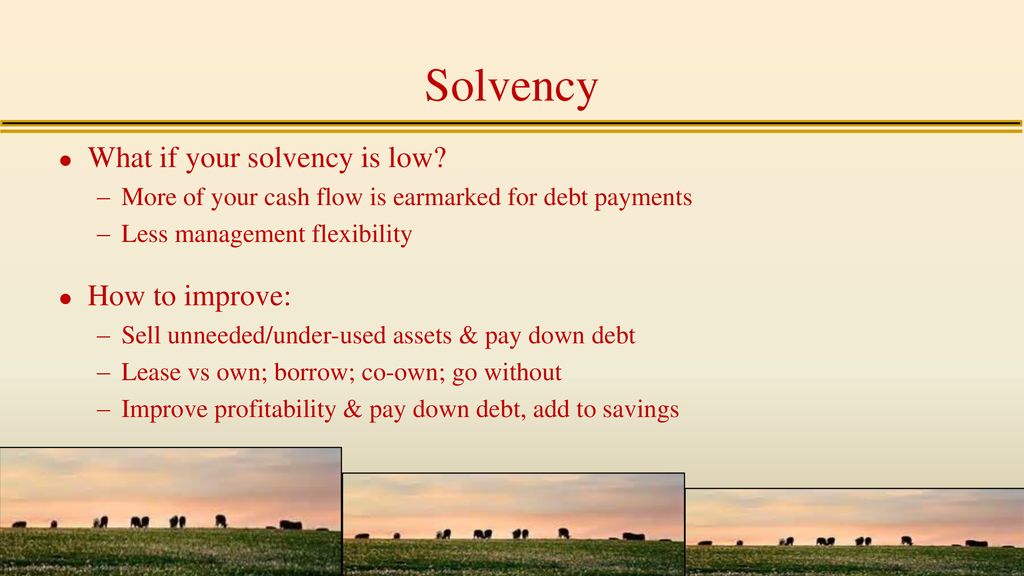

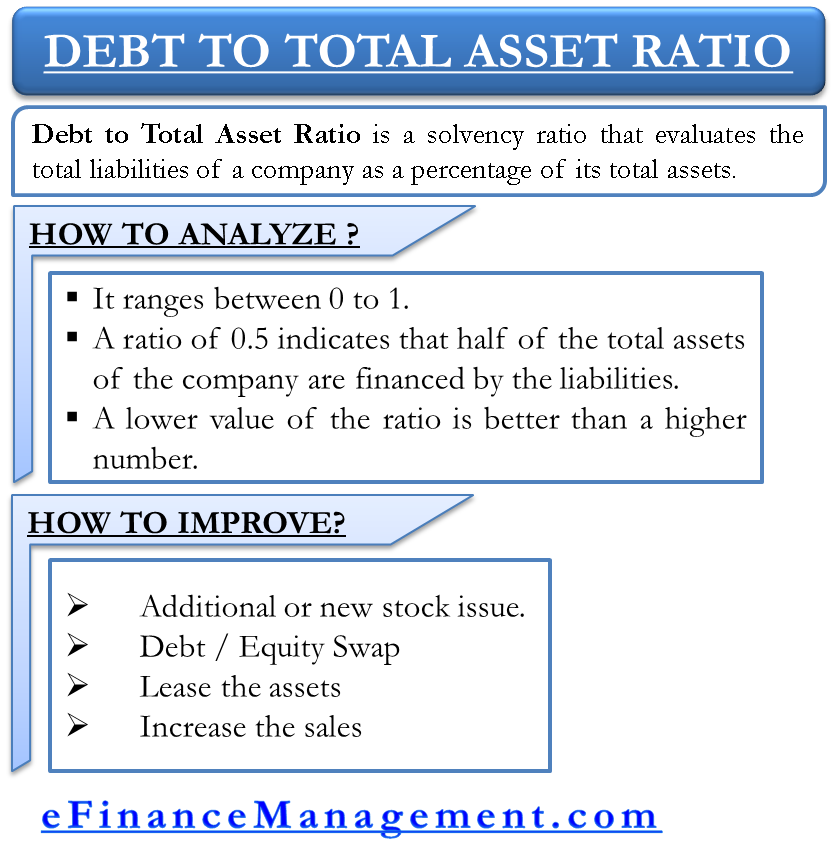

Up to 10% cash back improving this ratio means taking steps to either increase the value of your assets, or to pay off debt. This means to increase net profit you need to either increase sales, decrease cogs, decrease expenses or do a combination of all three. When solvency concerns arise, management can improve liquidity through various means.

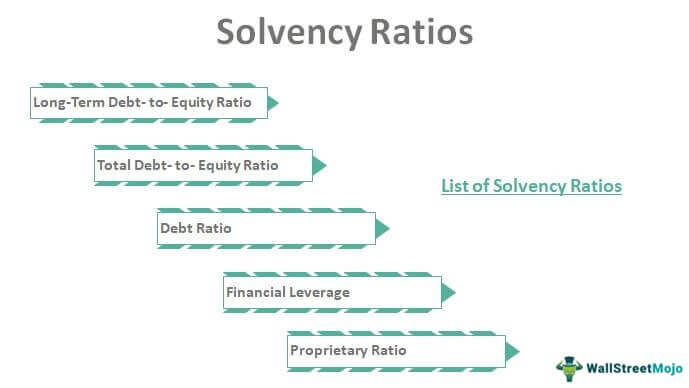

The most obvious way is to increase the company's assets. There are also other ratios that can help to more deeply analyze a company's solvency. For business owners, it should spur an effort to.

What is solvency in business? Restructuring debt, utilizing idle funds and reducing overhead are three possible means. How to improve your business’s solvency ratio 1.

A list of important solvency ratios are discussed below, followed by a numerical example: Manage your solvency ratios to make sure you can. A company that struggles with solvency when things are good is unlikely to fare well in a stressful economic environment.

This solvency ratio formula aims to. This can be done by selling assets, borrowing money, or raising equity. There are several ways to improve a company's solvency.

/what-are-solvency-ratios-and-what-do-they-measure-393211-v3-5c93aed046e0fb0001376ea2.png)

:max_bytes(150000):strip_icc():gifv()/solvencyratio_final-54e724fdd326470cbaae219a9dbea9dc.png)

/what-are-solvency-ratios-and-what-do-they-measure-393211-v3-5c93aed046e0fb0001376ea2.png)