Out Of This World Info About How To Buy A Credit Default Swap

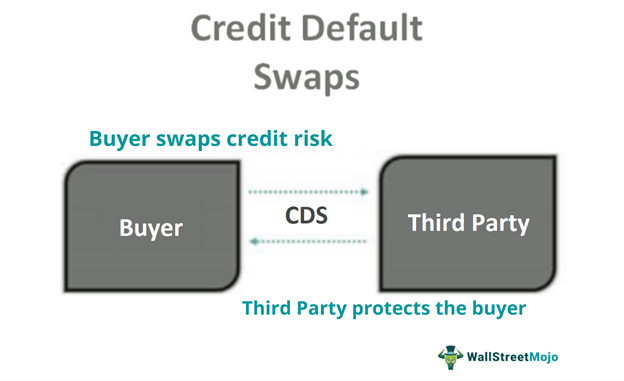

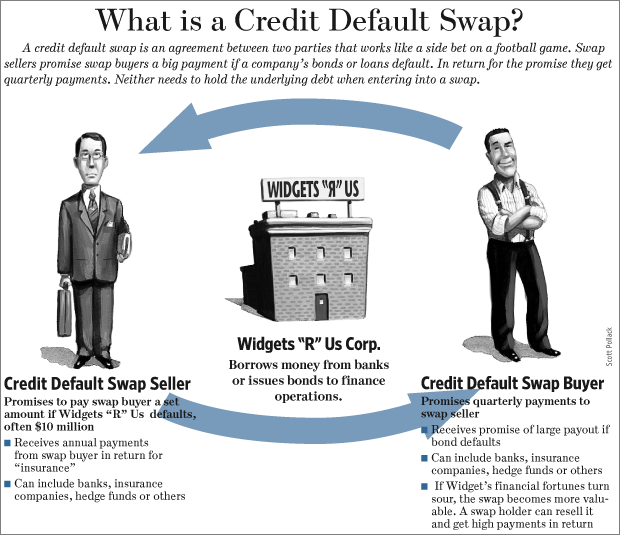

If there is a risk the private housing firm may default on repayments, the investment trust may buy a cds from a hedge fund.

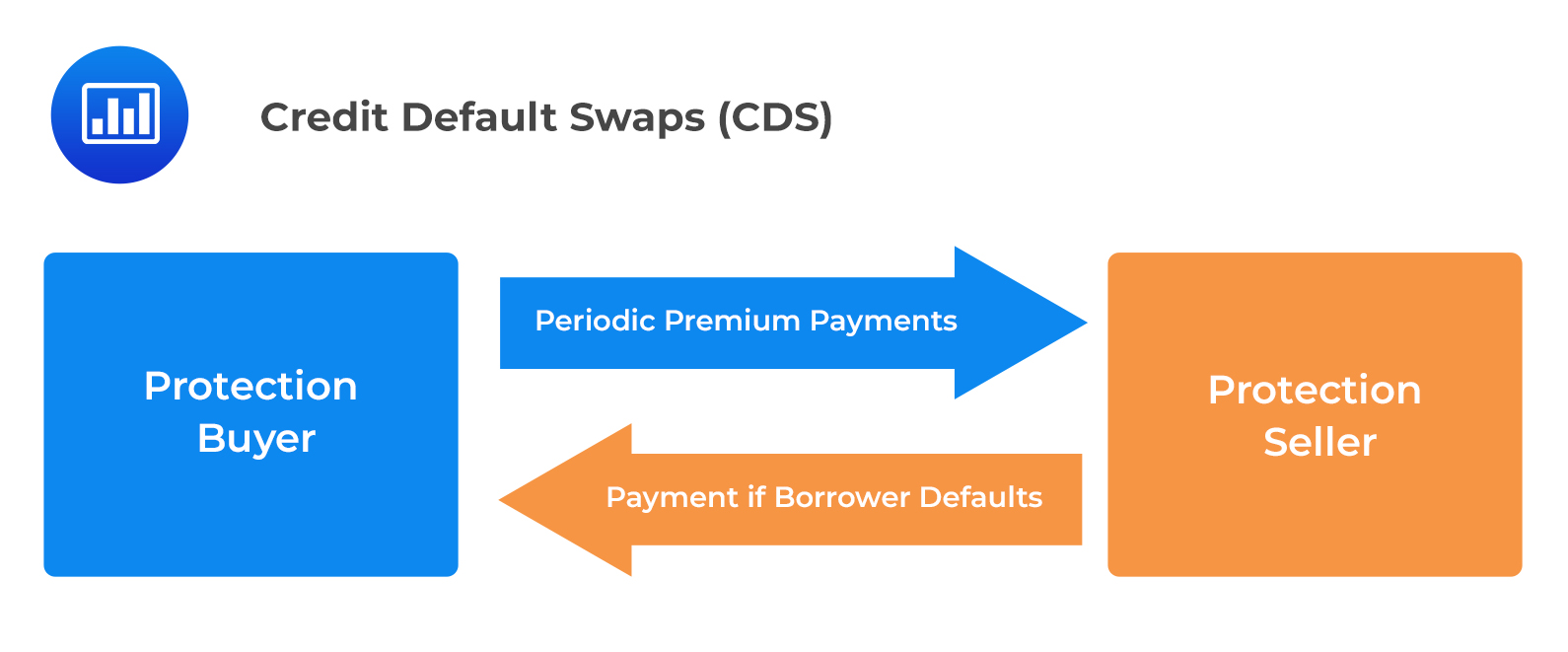

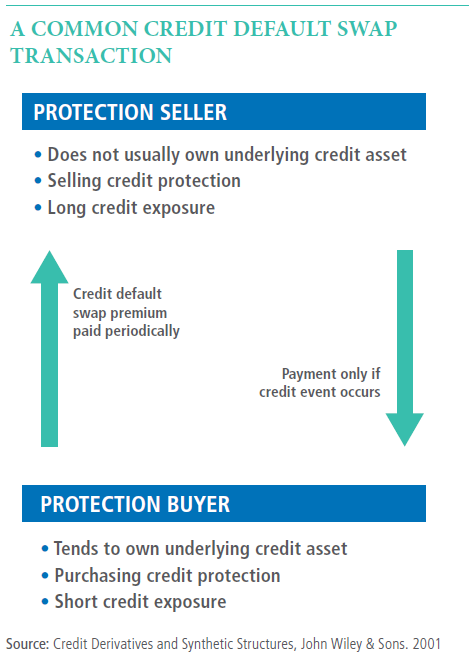

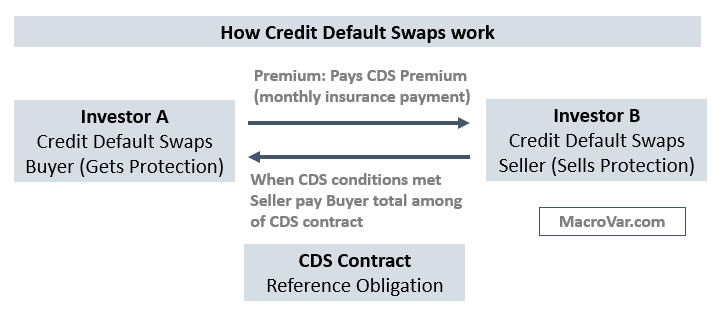

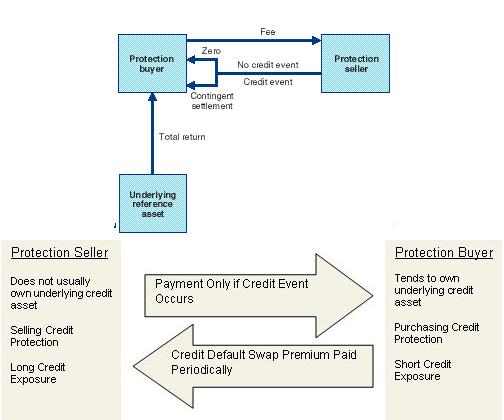

How to buy a credit default swap. The bank’s policy requires all loans to be backed by a credit default swap on the principal amount of loans made. The buyer of a credit default swap typically makes periodic payments to the seller until the maturity date, meaning the end of the contract, or until a credit event is triggered. A credit default swap (cds) is a financial swap agreement that the seller of the cds will compensate the buyer in the event of a debt default (by the debtor) or other credit event.

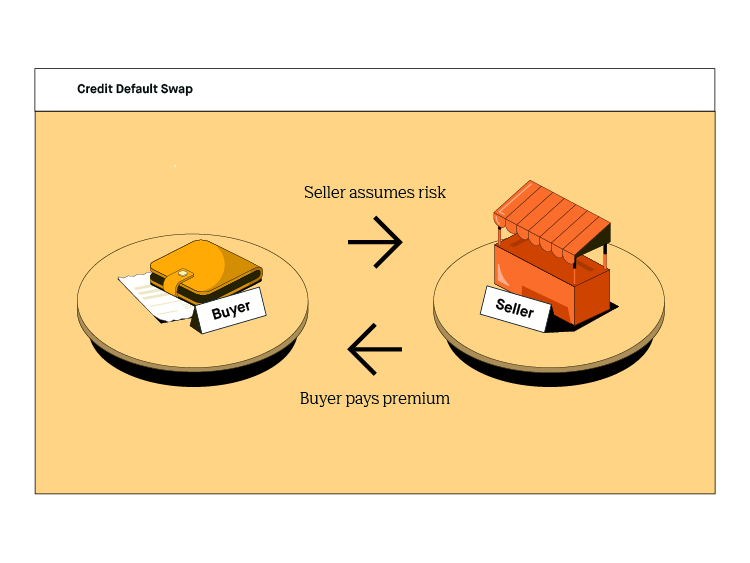

Also, you are better off shorting equity than the bonds, in the event of a. Below are the most common credit events that trigger a payment from the risk “buyer”. To swap the risk of default, the lender buys a cds from another investor who agrees to reimburse the lender in the case the borrower defaults.

The most vanilla way of putting on this trade is by shorting the abx index, which john paulson did. How do you do a credit default swap? The cds seller agrees to compensate the buyer in case the payment defaults.

The investor who's buying the cds. Putting on this trade gives you synthetic exposure to. In its most basic terms, a cds is similar to an insurance contract, providing the buyer with protection against specific risks.

Why did banks buy credit default swaps? In return, the cds buyer. Example of credit default swap.

A credit default swap (cds) is a contract between two parties in which one party purchases protection from another party against losses from the default of a borrower for a defined. Say a company issues a bond. How do you buy credit default swaps?

:max_bytes(150000):strip_icc():gifv()/TermDefinitions_Creditdefaultswap_finalv1-b682ce0e781d489db695637c6f884a82.png)