Marvelous Info About How To Reduce Accounts Receivable

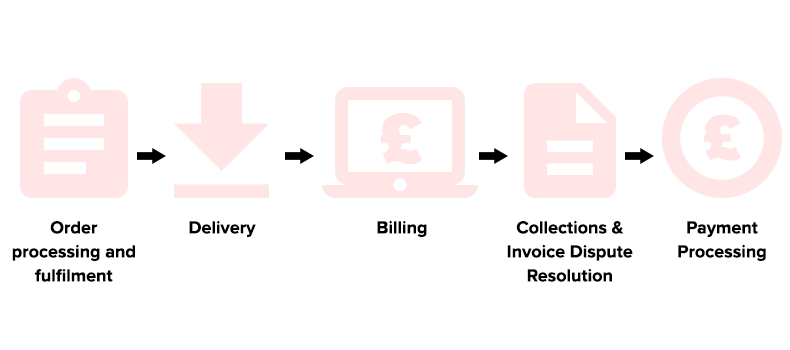

The accounts receivable process involves customer onboarding, invoicing, collections, deductions, exception management, and finally, cash posting after the payment is collected.

How to reduce accounts receivable. This is as bad debt expense. You can also ask for payment of any recovery fees, including legal fees, if the account is not paid. There are several things you can employ to reduce your number of outstanding accounts receivable and give you the cash on hand that you need to invest back into your firm.

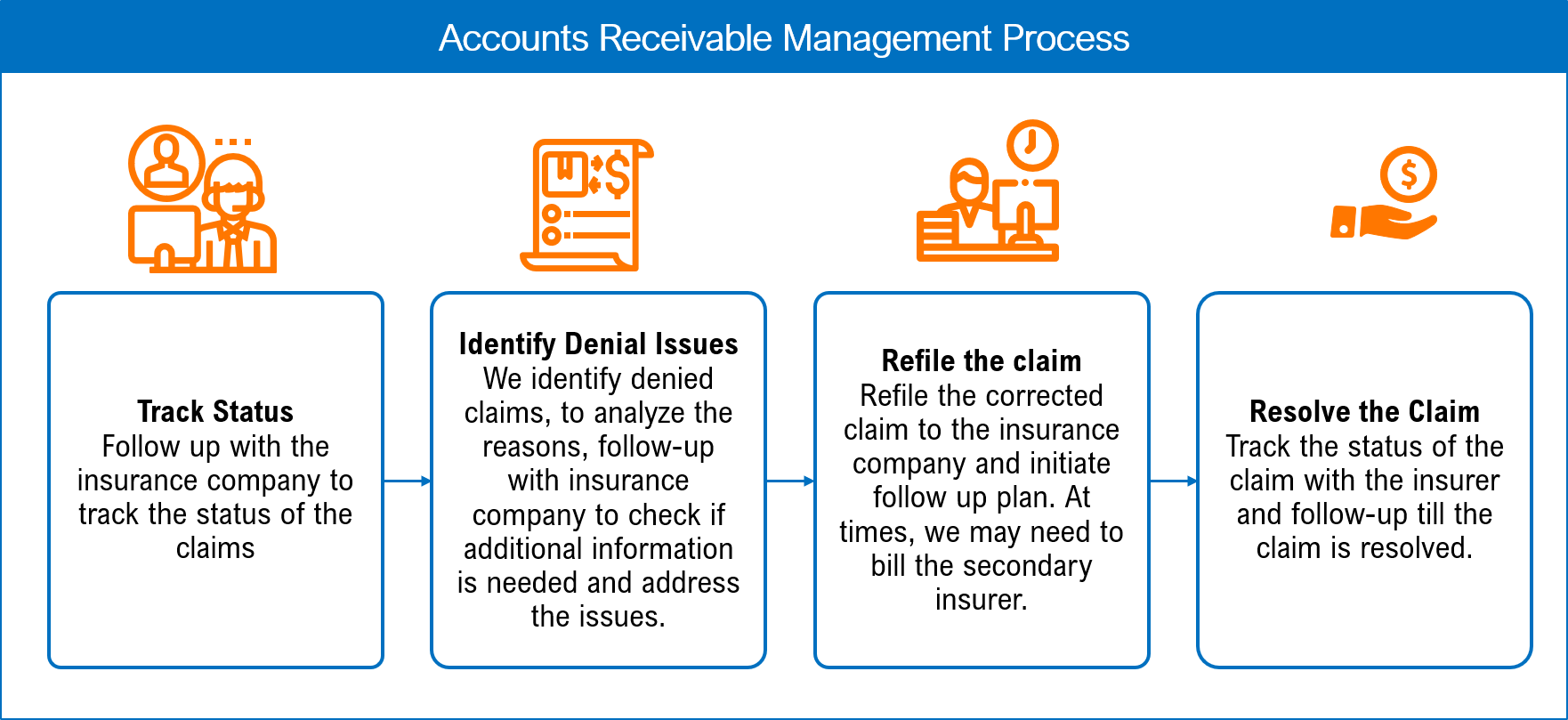

Medical billing is the most important part of the financial cycle; This sends a strong signal to the client that you are. If you experience a high.

Include payment terms set your accounts receivable up for success. The easiest way to adjust accounts receivable balances is to directly write off a customer's account that is deemed uncollectible. It can directly affect the workflow of any medical practice.

Don’t make your customers guess when you expect to be paid. Put all this on the front page. Dar = (total accounts receivables) ÷ (average daily charges) if the result is between 40 and 50, then your billing performances will be considered average.

By outsourcing billing and collection, medical practitioners can focus on the delivery of. Ask for interest if it's not paid within your terms. It’s also less daunting for customers to pay smaller, regular bills than to pay one large quarterly invoice.

The increase in collections rate will act a catalyst to reduce accounts receivable days. Super easy to get up and running. In order to reduce accounts receivable expenses and start using that money elsewhere, you must first identify where those costs are coming from.

:max_bytes(150000):strip_icc()/dotdash_Final_How_should_investors_interpret_accounts_receivable_information_on_a_companys_balance_sheet_Apr_2020-01-93d387c085e04ab4bf99fa38dcdfd48d.jpg)

![Save The Planet — Automate Your Accounts Receivable [Infographic]](https://24dlmn2bqamt1e72kah59881-wpengine.netdna-ssl.com/wp-content/uploads/2021/04/infographic_earthday_4_2021_final.jpg)